how much is virginia inheritance tax

Does West Virginia have an Inheritance Tax or an Estate Tax. Charitable and nonprofit organizations dont pay a tax if the amount is less than 500 but 10.

Free Virginia Tax Power Of Attorney Form Pdf

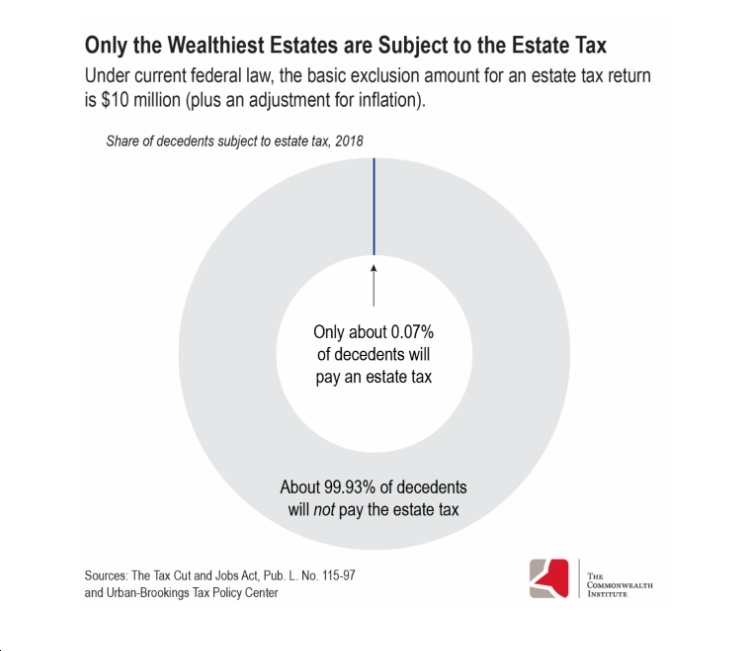

West Virginia collects neither an estate tax nor an inheritance tax.

. Unlike the federal government Virginia. States may also have their own estate tax. The Inheritance Tax charged will be 40 of 175000 500000 minus 325000.

The top estate tax rate is 16 percent exemption threshold. How do you avoid inheritance tax. 1- Make a gift to your partner or spouse.

Virginia estate tax. How much can you inherit without paying taxes in 2020. Return of Tangible Personal Property Machinery and Tools and Merchants Capital -.

Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance. With the elimination of. Price at Jenkins Fenstermaker PLLC by calling.

The estate can pay Inheritance. Today Virginia no longer has an estate tax or inheritance tax. No estate tax or inheritance tax.

The top estate tax rate is 16 percent exemption threshold. However state residents must remember to take. This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381.

Virginia estate tax. But just because Virginia does not have an estate. The top estate tax rate is 16 percent exemption.

Pennsylvania does charge an inheritance and estate tax in some cases. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. Virginia does not have an inheritance tax.

If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M. 2 Give money to family members and friends. Virginia Inheritance and Gift Tax.

This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381. Virginia Inheritance and Gift Tax. This is great news for Virginia residents.

Heres a breakdown of each states inheritance tax rate ranges. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption Virginia. Based on the value of the estate 18 to 40 federal estate tax brackets apply.

Another states inheritance tax may apply to you if the person leaving you money lived in a state that. 15 best ways to avoid inheritance tax in 2020. There is no federal inheritance tax but there is a federal estate tax.

Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. The top estate tax rate. Your estate is worth 500000 and your tax-free threshold is 325000.

How much is virginia inheritance tax. Inheritance tax rates differ by the state. How much can you inherit without paying taxes in virginia.

Virginia Estimated Payment Vouchers for Estates Trusts and Unified Nonresidents. You might inherit 100000 but you would pay an inheritance tax on only 50000. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth.

How Much Is the Inheritance Tax. Unlike the federal government Virginia does not have an estate tax.

Virginia State Tax Guide Kiplinger

State Corporate Income Tax Rates And Brackets Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

Estate And Inheritance Taxes Urban Institute

State Tax Proposals Would Make Virginia S Tax System More Fair Blue Virginia

Estate And Trust Tax Kwc Alexandria Virginia Accounting

Is Your Inheritance Considered Taxable Income H R Block

New Jersey Estate Tax Changes Mccarthy Weidler Pc

Virginia Income Tax Calculator Smartasset

Estate Tax Might Get Reinstated In Virginia Family Enterprise Usa

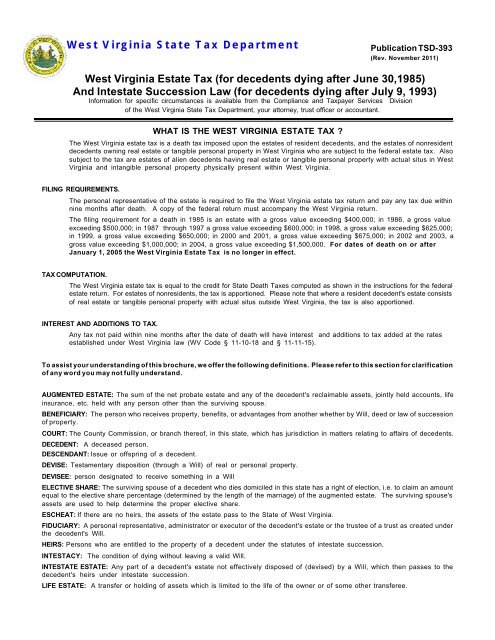

What Is The West Virginia Estate Tax Publication Tsd 393

Assessing The Impact Of State Estate Taxes Revised 12 19 06

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

State Estate And Inheritance Taxes Itep